CRYPTOCOIN INSURANCE

The first option exchange with the possibility of insuring deposits against falls.

Large and fully free markets that do not yet have technical solutions

We provide your efficiency for the following centuries

Large and fully free markets that do not yet have technical solutions

We provide your efficiency for the following centuries

About the project

Options are financial derivatives sold by option authors for option buyers. The contract offers the buyer the right, but not the obligation, to buy (call option) or sell (put option) the underlying asset at an agreed price over a specified period of time or on a specific date. The agreed price is called the strike price. There are many types of options. One option can be done at any time before the option expiration date, while other options can only be done on the expiration date (training date). Exercising means using the right to buy or sell the underlying security.

Sounds very difficult! That’s why this project is divided into two parts: option exchanges and insurance companies.

- Traders and hedge funds conclude stock option purchase and sale transactions

- Other clients, who don’t want to know how to work options can buy insurance for the growth or fall of the main crypto currency.

CRYPTOCOIN INSURANCE allows you to ensure falling prices or growth risks for major cryptocurrency.

Problem: There is no solution to ensure deposits on Bitcoin or Ethereum do not fall. At the same time in this market there is an increase in volatility that makes people afraid to save large funds in cryptocurrency. On the other hand, large companies are slow to enter the market (for example, to receive payments in cryptocurrency) for the same reason.

Solution: Exchange will begin to operate with 5 cryptocurrency that has a maximum market. Furthermore, as demand and turnover increases, we will add other crypto currencies. CRYPTOCOIN INSURANCE sells both the growth of Bitcoin or Ethereum and insurance falls. Thus, it protects the risk. There is no competition in the market which allows maintaining a significant margin at the level of 20%. INSURANCE CRYPTOCOIN repackages and sells / buys its own risk as an option in its own exchange.

INSURANCE CRYPTOCOIN launches the world’s first cryptocurrency currency exchange

Problem: There is no special cryptocurrency exchange where you can buy / sell options. The main fear of creating such a stock exchange is increasing volatility as well. It seems everyone who deals with options for stocks, oil or wheat that the risk is very large.

Solution: The main fear of options in the cryptocurrency market is an increase in volatility. But is that true?

Let’s consider an example with a custom stock market. For example, clients sell options for parts of the ZZZ Company. Today is Saturday, and the market is closed. There was unexpected good news and stocks grew 2–10 times at the opening of the market on Monday. In turn, option sellers suffer heavy losses.

The advantage of the cryptocurrency market unlike stocks or commodities is that it operates 24 hours a day. And for the entire period of its existence (around 10 years), there has never been news that will quickly shift the price of Bitcoin or Ethereum at least 30–50%. In fact, if it’s only a blue chip (coin), the cryptocurrency market is much safer for option sellers than other markets we are accustomed to.

Options allow short sales

Problem: There are still no short sales opportunities in the cryptocurrency market. No one can sell cryptocurrency that is physically not in the account in a short time. This reduces the ability of speculators to smooth price fluctuations in other markets. In turn it causes an increase in volatility and the consequences mentioned in the clause. 1 and 2 above.

Solution: Without having physical Bitcoin or Ethereum, it is possible to get the option to fall, and actually carry out unrevealed sales. This opportunity brought to the market many new traders, investors and speculators, as well as hedge funds that put money not only on growth but also in the fall of the market.

Market size

Cryptocurrency market capitalization amounts to hundreds of billions of dollars. Daily trading volume is at the level of $ 10–20 billion.

Option market sizes for commodities and stocks differ from country to country, and are 1–5% of the total underlying asset market. Thus, we can calculate the potential volume of the option market for basic cryptocurrency in the amount of $ 50–250 million per day.

However, the calculation does not take into account that the options really provide opportunities for short sales that cannot currently be done on cryptocurrency exchanges. This will contribute to additional increases in seller demand for instruments.

Token Allocation

Allocation of funds collected

Roadmap

- Creating the concept of insuring the movement of the cryptocurrency market and exchanging options for CRYPTOCOIN INSURANCE

- February 2018

- Establish a project team

- March-April 2018

- Market research, defines competitive advantage

- May 2018

- Start preparing for ICO

- June 2018

- Launch the exchange option with 5 cryptocurrency

- February 2019

- List CCIN tokens and listings on the cryptocurrency exchange

- January 2019

- ICO

- November-December 2018

- Ad campaign

- August-October 2018

- Early insurance sales

for market growth / fall - March 2019

- Redemption of the first token from the market and burn it

- April 2019

- Add 3 new cryptocurrency

- May 2019

- Daily turnover of 10 million dollars

- July 2019

- Daily turnover in the amount of $ 50 million

- December 2019

- Add 2 cryptocurrency (10 total) to the exchange

- September 2019

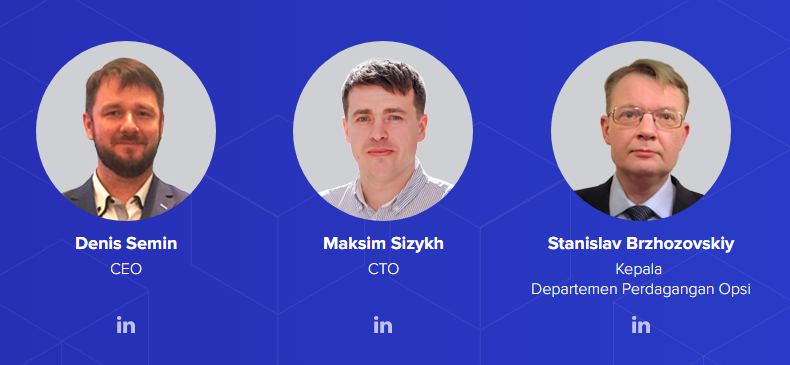

tim

For more information about CRYPTOCOIN INSURANCE, visit this link.

writer: AlexSukaRondoz

Tidak ada komentar:

Posting Komentar